As banks continue their shift toward data-driven operations, one capability is at the top of strategic agendas: decision intelligence. The ability to make accurate and timely decisions across a wide range of functions—from fraud detection to credit underwriting and customer experience—has become foundational to modern banking.

But even as financial institutions adopt more sophisticated models and analytics platforms, many still face a frustrating and persistent obstacle: their data architecture. Without consistent, high-quality, and accessible data, and more importantly, without the right data, decision intelligence systems often underperform, or worse, make decisions based on incomplete or outdated information. In fact, 57% of banks cite access to quality and timely data as one of their top concerns when it comes to improving model performance.

A report by Celent, commissioned by InterSystems, dives into this challenge and identifies a promising path forward: the adoption of smart data fabric architecture. Below, we explore the core findings and what they mean for banking leaders.

What Is Decision Intelligence—and Why Does It Matter?

At its core, decision intelligence refers to systems that blend business rules, data analytics, and machine learning/artificial intelligence to inform and automate decision-making. Decision intelligence platforms empower business users to access and leverage data-driven insights without deep technical expertise. Unlike traditional business intelligence, which focuses on reporting, dashboards, and descriptive analytics, decision intelligence has evolved to deliver real-time, automated, and predictive insights that drive strategic value. They are particularly valuable for managing complex decisions in dynamic banking environments, enabling intelligent decision making by integrating AI-driven, real-time, and automated processes.

These systems are already central to many critical workflows in financial services. For example:

- Fraud detection and prevention: Fraud risk is a top area of concern among banks. As real-time payments become more common, banks must evaluate the legitimacy of transactions within milliseconds to prevent losses without increasing false positives.

- Credit risk assessment: Customers applying for credit online expect instant decisions. That means banks need models that can rapidly assess risk and pricing, based on current and historical data.

- Payments intelligence: Automating payment processing involves monitoring and analyzing payment flows to optimize transaction processing, detect anomalies, and ensure compliance, all while enhancing the customer experience. These platforms automate decisions and feature automated decision making as a core capability.

- Customer insights and personalization: Decision intelligence powers real-time personalization engines—such as presenting the right offer at the right time based on recent activity or channel behavior.

- Operational decisions: Decision intelligence also impacts day-to-day operational decisions, enabling banks to optimize business functions.

These systems rely not only on strong models but also on timely, trusted, and well-integrated data. However, despite years of investment in data infrastructure, many banks still struggle with fragmented systems, poor data quality, and sluggish data pipelines.

The Benefits of Decision Intelligence in Banking

Decision intelligence represents a transformative shift in how banks approach decision making across their value chain. By harnessing artificial intelligence, machine learning, and natural language processing, financial institutions can analyze massive volumes of data to uncover patterns, predict outcomes, and make data driven decisions with greater confidence. Decision intelligence platforms empower banks to optimize their operations, reduce credit risk, and deliver more personalized banking services.

With a complete view of each customer, banks can tailor products and services to individual needs, enhancing the overall customer experience and driving customer satisfaction. These platforms also help banks proactively identify and mitigate fraud risk, improving their credit rating and ensuring compliance with evolving regulatory requirements. By making smarter, faster decisions, banks can not only protect themselves from losses but also unlock new opportunities for growth in an increasingly competitive market. Ultimately, decision intelligence enables banks to move beyond intuition and guesswork, creating a culture of data driven decision making that benefits both the institution and its customers.

What’s Holding Back Decision Intelligence?

Celent’s research surveyed over 100 executives from Tier 1 and Tier 2 banks across North America and the UK. One finding stood out: 60% of Tier 1 banks cited their existing data architectures as a barrier to improving decision intelligence.

This isn’t due to a lack of investment. Most banks have spent years building centralized data warehouses, deploying cloud platforms, and implementing enterprise-wide data lakes. These systems were designed to consolidate and store data at scale, with the promise of delivering a “single source of truth.”

But storing data isn’t the same as using it effectively. Many of these traditional systems:

- Can’t easily ingest or integrate new data sources

- Introduce latency that slows down time-sensitive decision-making

- Lack the flexibility to serve dynamic or real-time use cases

As banking becomes more immediate—with services like instant payments, embedded lending, and mobile onboarding—the shortcomings of centralized, batch-based data platforms become harder to ignore. Increasing regulatory pressure further complicates data management and decision-making processes, as banks must ensure transparency, fairness, and compliance while adapting to evolving requirements.

The Data Dilemma: Why Traditional Architectures Fall Short

The Celent research clearly highlights that "data challenges are pervasive barriers to improving decision intelligence and model performance."

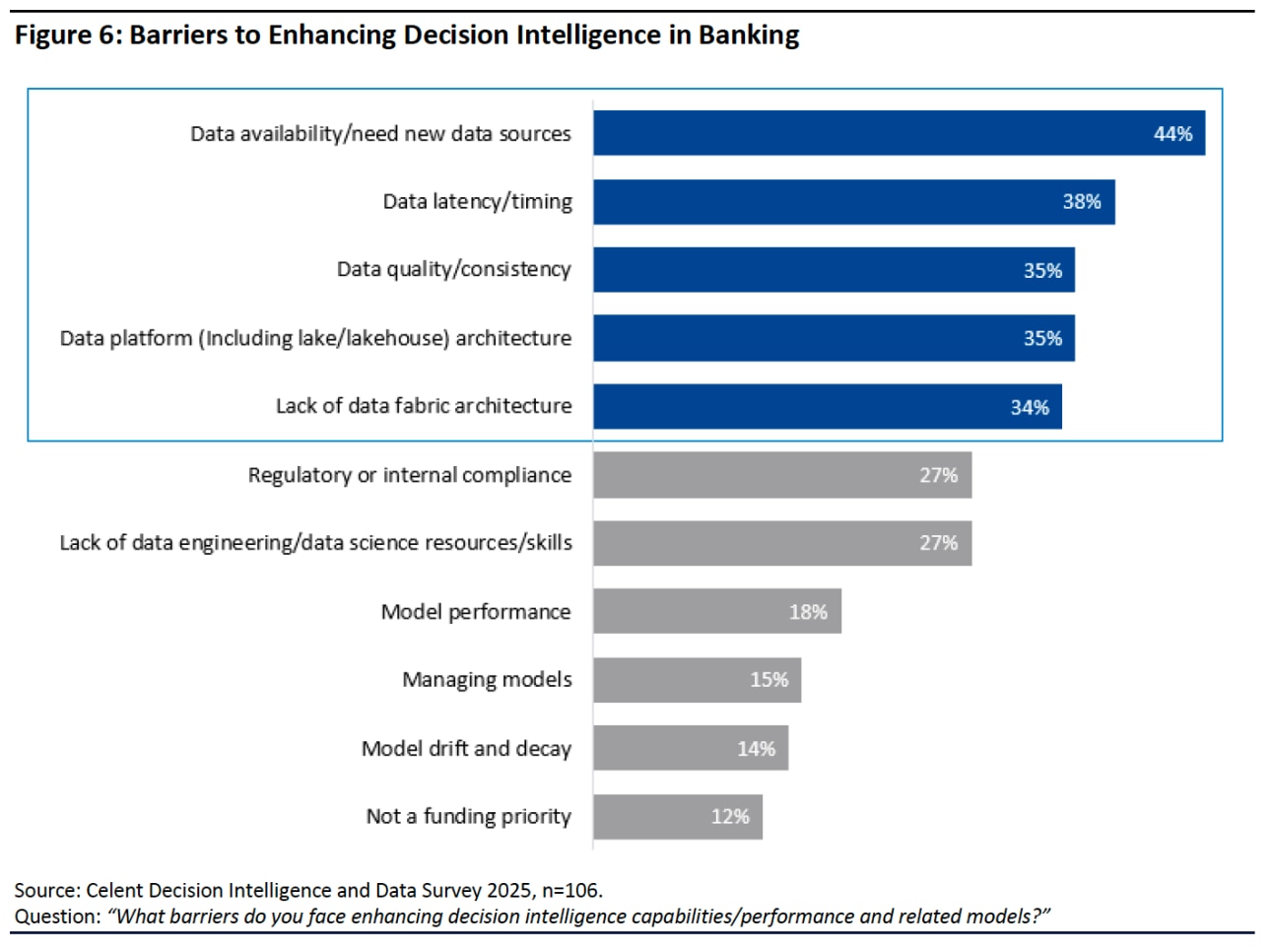

While traditional architectures were designed to consolidate data, improve governance, and support analytics they have revealed critical limitations as the demands of real-time decision intelligence have grown. As the chart above illustrates, data management, including existing data platforms, like data lakes and lakehouses, as one of their top barriers to enhancing decision intelligence.

Data silos remain a persistent issue. Despite centralization efforts, many banks still operate with fragmented systems across business units and geographies. This fragmentation makes it difficult to integrate new data sources—a challenge cited by 58% of banks in Celent’s survey as a top barrier to enhancing decision intelligence.

Latency is another major concern. Traditional data platforms often rely on batch processing, which introduces delays that are incompatible with the real-time requirements of fraud detection, payment processing, and credit decisioning. According to the report, data latency was identified by 38% of respondents as a key obstacle to improving model performance.

Data quality issues further compound the problem. Inconsistent, incomplete, or outdated data undermines the reliability of AI and analytics models. The survey found that access to quality and timely data was a critical concern for 57% of the banks surveyed, as illustrated in the chart below, directly impacting the accuracy and trustworthiness of decision intelligence outputs.

These challenges are not just technical—they have real business consequences. A delay in detecting fraudulent activity can result in financial losses and reputational damage. Inaccurate credit risk assessments can lead to increased defaults or missed lending opportunities. And poor customer insights can erode loyalty in an increasingly competitive market.

What’s clear from the Celent report is that traditional data architectures, while foundational, are no longer sufficient on their own. To meet the speed, scale, and complexity of modern banking, institutions must evolve toward more agile, integrated, and intelligent data frameworks—such as smart data fabrics—that can address these root causes and unlock the full potential of decision intelligence.

The Rise of the AI-Enabled Smart Data Fabric

To address this challenge, banks are increasingly looking to smart data fabric architecture as an alternative—or complement—to centralized data platforms.

Key Features of a Smart Data Fabric:

- Real-time data access: Connects directly to source systems, eliminating the need for batch processing.

- AI and ML integration: Embeds analytics and machine learning capabilities within the fabric itself.

- Non-disruptive deployment: Works alongside existing data infrastructure without requiring a complete overhaul.

- Dynamic scalability: Supports both operational and analytical workloads across diverse environments.

A decision intelligence platform built on smart data fabric architecture can integrate, automate, and optimize decision-making processes across the bank, supporting data-driven strategies and improved operational efficiency.

Unlike traditional data lakes or warehouses, which require data to be moved and stored before it can be used, a smart data fabric accesses and processes data in motion, reducing duplication and latency.

According to Celent, 55% of banks plan to deploy data fabric architecture within the next year. Among Tier 1 banks, this number is likely even higher.

Common Use Cases for Data Fabric in Banking: Credit Risk, Fraud, and Customer Intelligence

Smart data fabrics are particularly well-suited for functions where both data velocity and data variety are high. Examples include:

- Credit origination, risk, and pricing: Pull together income data, behavioral scores, alternative credit signals, and policy rules at the point of application.

- Real-time fraud detection: Detect patterns across transactions, accounts, and external feeds with minimal latency.

- Customer intelligence: Provide a unified view across banking products, even if the underlying systems were built decades apart.

Moreover, smart data fabrics can support compliance and regulatory reporting by ensuring consistent, traceable data flow across business units—helping banks manage risk without sacrificing flexibility.

From Data to Actionable Insights

Turning raw data into actionable insights is the cornerstone of effective decision intelligence. Smart data fabrics facilitate this process with robust data management practices, including seamless data ingestion from multiple systems and automated data processing to ensure accuracy and relevance. As the Celent report highlights, integrating diverse data sources is crucial for improving decision intelligence in banking.

By adopting a smart data fabric approach, banks can extract relevant insights from both historical and real-time data, enabling them to identify emerging trends, predict outcomes, and create solutions that address specific business challenges. Real time insights empower banks to respond swiftly to market shifts, evolving customer needs, and regulatory changes, ensuring that their decision making capabilities remain agile and informed. Ultimately, this ability to transform data into actionable intelligence is what sets leading banks apart in today’s data driven landscape.

Complementary, Not Replacing

A key benefit of the smart data fabric approach is that it doesn’t require banks to replace their existing systems. Instead, it overlays the existing architecture, enabling real-time connectivity, transformation, and delivery of data from multiple environments.

This makes it especially useful for banks navigating staged cloud migrations or operating in hybrid environments. As new data sources emerge—whether internal APIs, third-party services, or ecosystem platforms—the data fabric can absorb them without major architectural disruption.

Solutions like those offered by InterSystems also embed AI and machine learning capabilities into the fabric itself, allowing banks to streamline operations and accelerate time-to-insight without constantly moving data across environments.

Investment Trends and Priorities

Banks are responding to this architectural shift with targeted investments. According to Celent:

- 55% of banks plan to deploy a data fabric architecture in the next 12 months.

- Credit risk and payments processing are top priorities for new model development and performance tuning

- Banks are increasingly focused on enhancing existing models, not just building new ones

Interestingly, UK banks showed particularly high urgency around improving fraud models, while Canadian institutions were more concerned about credit risk model performance.

What’s clear across regions is that AI and decision intelligence remain top priorities—but without high-quality data, those investments won’t yield their full value.

The Future of Decision Intelligence in Banking

The future of decision intelligence in banking is poised for rapid evolution as technology continues to advance. Next-generation decision intelligence platforms will leverage artificial intelligence, machine learning, and natural language processing to analyze increasingly complex systems and deliver predictive insights at scale. The integration of unstructured data will open new avenues for valuable insights, further enhancing banks’ ability to make data driven decisions.

As banks automate decision making and orchestrate more of their operations through intelligent platforms, they will be able to respond to customer needs in real time, improve customer satisfaction, and drive significant benefits such as increased revenue and reduced costs. The ongoing digital transformation of banking services will make decision intelligence a core competency, enabling institutions to navigate uncertainty, seize new opportunities, and fuel sustainable business growth. In this new era, decision intelligence will not only support optimal decisions but also redefine what’s possible in financial services.

Final Thoughts: Aligning Architecture with Ambition

As banks push to modernize their operations and differentiate through digital experiences, decision intelligence will continue to be a critical enabler. But to be effective, it requires a supporting data environment that is flexible, fast, and fit for purpose.

Smart data fabric architecture offers a way to bridge the gap between legacy infrastructure and modern data demands. It’s not a replacement for previous investments—it’s a framework for unlocking their value.

For banks rethinking how they deliver data to the point of decision, now is the time to explore whether their current data architecture aligns with their business objectives. Transforming how data is accessed and integrated through a smart data fabric can have a measurable impact on how decisions are made—and how effectively institutions can serve their customers.

Learn more: Download the Celent report "It's All About the Data!".

Visit InterSystems Financial Services to explore how smart data fabrics are helping banks modernize data delivery and unlock better decision intelligence.