CUSTOMER:

Mid-Sized Asset Management Firm

CHALLENGE:

Enable data-driven decision making in sales, marketing, operations, and investment management by establishing an enterprise-wide single source of truth from multiple internal and external data sources.

OUTCOME:

• Driving differentiation with a proprietary client reporting solution.

• Creating a competitive advantage across marketing, RFP/RFI requests, and on-demand investment riskinsights.

• Launched a proprietary investment risk analytics platform in less than 6 months.

• Delivering efficiencies by reallocating 200 FTE hours per month to higher value projects.

Decision makers at a mid-sized independent asset management firm are now able to access and use timely, consistent, and relevant data to serve multiple business use cases, thanks to InterSystems.

The asset management firm, managing more than $100 billion in equity and fixed income portfolios, implemented InterSystems® Data Studio™ with asset management module to connect disparate data spread across spreadsheets, data lakes, data warehouses, and data marts. By automating much of their data processing the firm saw immediate benefits, including being able to operationalize a proprietary investment risk analytics platform in less than 6 months.

Since implementing Data Studio, the firm has realized significant long- and short-term business benefits, including:

- Differentiating itself among peers by enhancing their clients’ experience with a proprietary reporting solution. They would not have attempted to create this reporting system if they didn’t already have all of their data in a single platform.

- Creating a competitive advantage by enabling sales and marketing teams to respond to ad-hoc client and RFP/RFI requests and improving distribution and marketing efforts. This was made possible by automating daily and monthly flows/assets reporting and analytics.

- Retaining and attracting clients by streamlining the launch of new products and wrappers through seamless data management.

- Delivering cost savings by automating data processing which enhanced the performance of analytics systems. This enabled the firm to retire expensive legacy systems and reallocate scarce data and analytics resources to more valuable projects.

“Working with InterSystems has opened up new possibilities for growth and client retention,” affirms the firm’s head of data and analytics. “InterSystems Data Studio is being leveraged across the business as part of ongoing strategic long-term planning and decision making.”

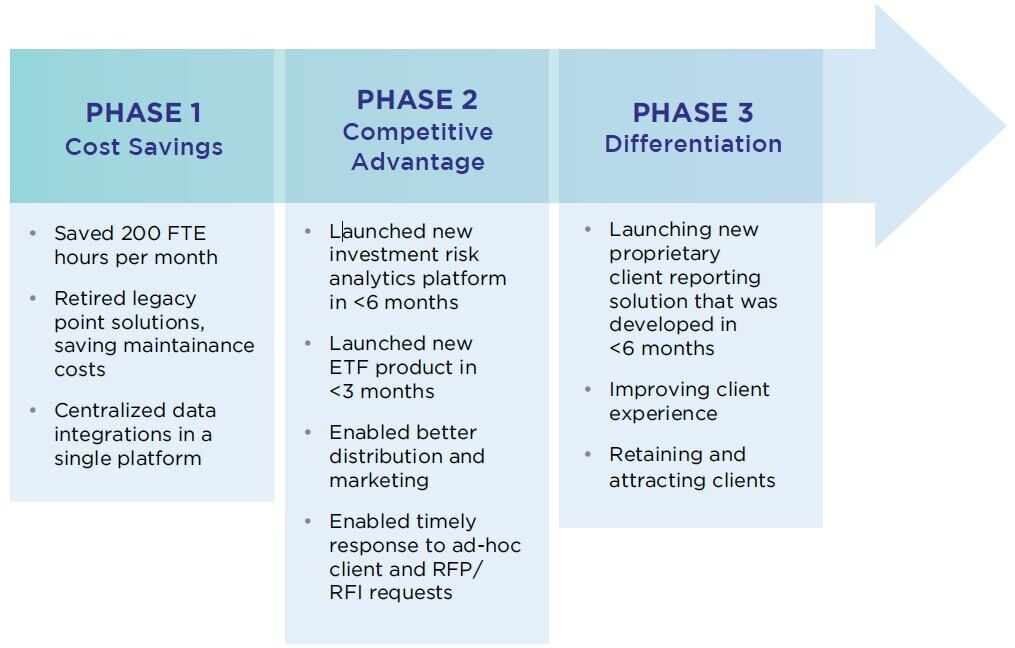

The full value of the InterSystems solution was realized in three distinct phases.

Phase 1: Cost Savings

Doing More with Existing Resources and Cutting Costs

Over the years, the firm had explored various approaches and technologies to better leverage all the disparate data and processes they need to run the business. These included manual methods, spreadsheets, data lakes, data warehouses, and data marts. All of these approaches came with significant limitations, such as data duplication, batch processing complexity and delays, inflexible architectures, inability for business users to explore the data on their own, and constant maintenance requirements.

The firm was seeking a better solution based on a modern approach to data management that could dynamically access and use data from any source. Their goal was to create a trusted source of data that could be plugged into any application or analytics engine, eliminating the limitations of previous approaches.

InterSystems Data Studio delivers a fully-managed, cloud-hosted solution with all of the elements the client required to create and maintain a smart data fabric, including:

- Data ingestion layer: ETL with a scheduling layer

- Messaging infrastructure

- Data persistence layer

- Semantic layer

- Data quality and integrity layer

- Accessibility via API/driver based/SQL/visualization tools (PowerBI and Tableau)

By automating the data processing required for two initial use cases, the client was able to reallocate about 200 full-time employee (FTE) hours per month to other, higher-value projects. These savings are expected to accrue with each new use case as the firm does not need additional staff to expand the use of the InterSystems solution.

As a result of the new data architecture, the data and analytics team saw an overall improvement in performance, which enabled them to retire a number of legacy point solutions, saving $50-60K per year in maintenance, support, and development.

Building a solution from scratch is a complex multi-year project, and the effort and cost saved by implementing a single solution with all the necessary components already available has been invaluable to the firm.

As a managed service, Data Studio has reduced the amount of time spent dealing with security, patching, vulnerabilities, and all other operational costs associated with internally managed solutions.

In addition, making the strategic decision to implement a smart data fabric offers the data and analytics team the flexibility to integrate any data source and to facilitate data interchange in a single platform without the need to maintain multiple internal integrations. Leveraging a central data platform to manage integrations makes it easier and less risky to make integration decisions with key vendors.

“The immediate result of our partnership with InterSystems has been a significant reduction in the amount of manual effort expended by different teams aggregating and analyzing data from different sources,” says the firm’s head of data and analytics. “The data and analytics team is now able to focus on higher-value projects for the firm.”

Spotlight on

Transaction Cost Analytics (TCA)

Phase 2: Competitive Advantage

Rapid Delivery of Client Reporting and Analytics Leads to Business Growth

As a value investor, this asset manager is always looking for ways to manage risk, lower costs, and understand the intrinsic value of its investments. With each new data set that the firm added into the InterSystems solution, business decision-makers easily accessed data that provided insight into performance at a portfolio and customer-level. These new business reporting capabilities facilitated better distribution and marketing, enabling the firm to respond to ad-hoc client and RFP/RFI requests in a timely manner.

The asset management firm operationalized a proprietary investment risk analytics platform built on top of InterSystems Data Studio in less than 6 months, providing both clients and portfolio managers with investment risk insights on demand.

In 2024 the firm launched their first ETF product. In the past, launching a new product required more than 6 months of work to implement point-to-point integrations and manual data processing. With InterSystems, they were able to automate these tasks, reducing the time to approximately 3 months. The firm anticipates being able to further reduce the time required for data-related tasks for future ETF launches to a matter of weeks.

The firm enabled better distribution and marketing by automating the daily and monthly flows and assets reporting, as well as the analytics across all intermediaries of their funds.

In addition, the firm automated several manual reports, such as flows/assets, for the marketing teams, enabling them to efficiently respond to ad-hoc client and RFP/RFI requests from institutional clients in a timely manner.

InterSystems has enabled the firm to achieve a distinct, sustained, competitive advantage by delivering a service that helped them retain existing clients and win new mandates, delivering top line growth.

Phase 3: Differentiation

Charting a New Course in a Competitive Industry

The asset management landscape is increasingly saturated with both established firms and new entrants. To stand out, fund managers must differentiate themselves.

For our client, the ability to automate data management has opened up new possibilities for growth and client retention by leveraging resources they already have. The value of Data Studio is being realized across the business as part of the firm’s strategic long-term planning and decision-making.

With more data regularly added to the platform, the data and analytics team launched a strategic initiative to develop capabilities that will set the firm apart in the industry. The firm is launching a new proprietary client reporting solution that will significantly enhance the client experience, helping to differentiate them from their peers, many of whom tend to use the same vendor solutions. They would not have pursued this course if it required building an internally developed data integration solution, nor would they have implemented a new data platform exclusively for this project.

Conclusion

The asset management firm’s use of InterSystems Data Studio and its continued expansion of use cases from financial reporting to sales and marketing has had a positive impact on the firm’s top and bottom line. By continuing to add new datasets to their smart data fabric, the firm is able to empower all decision-makers with the data they need to better serve existing clients and to win new mandates.

By automating manual data processing, the firm is able to reallocate its scarce data and analytics resources to high-value projects using the latest quantitative methodologies, enabling them to deliver a competitive advantage and differentiate the firm from its peers.

According to the firm’s head of data and analytics, they have future-proofed their data strategy with an approach to data that will help the entire asset management industry realize the full value of their data assets.

“The partnership with InterSystems is providing economies of scale we would not be able to achieve with internal resources,” says the head of data and analytics. “InterSystems is an extension of our data engineering team, enabling us to deliver on our strategic initiatives and provide business value across the firm.”