Institutional Client 360 for Financial Services Firms

Overview of Institutional Client 360

Financial services organizations face a number of challenges to developing, maintaining and fully leveraging a complete and current 360-degree understanding of each institutional client. Common obstacles include:

- Complex global clients

- Increasing competitive intensity

- Heightened client service expectations, and

- Dispersion of client data across applications and data silos

InterSystems enables financial services firms to deepen their institutional relationships and grow revenue by providing access to all customer activity and information from both inside and outside the organization.

Armed with these insights, firms can proactively anticipate clients’ needs, quickly respond to emerging opportunities and issues, and provide a differentiated, high-value, hyperpersonalized experience.

The Challenge

Although investment performance is the predominant factor by which clients judge investment managers, institutional investors increasingly view a superior client experience as a critical requirement. Consequently, managers must be able to demonstrate a strong understanding of their clients and deliver high-quality, customized experiences quickly and efficiently.

However, there is a complexity to global institutional clients and their interactions with a firm. Multiple stakeholders within each client’s organization typically interact with multiple individuals within a financial services institution, which makes it difficult for managers to easily grasp the scope and details of an entire relationship.

While financial services firms maintain a tremendous amount of data about their clients, they are often unable to effectively use it to drive their clients’ experiences, due to the challenges of combining the data from its various sources and systems, including customer service, relationship management, and fulfillment.

The need to combine and analyze the data in near real time to meet clients’ heightened fulfillment and issue-resolution expectations makes it more difficult to obtain accurate insights.

The Solution

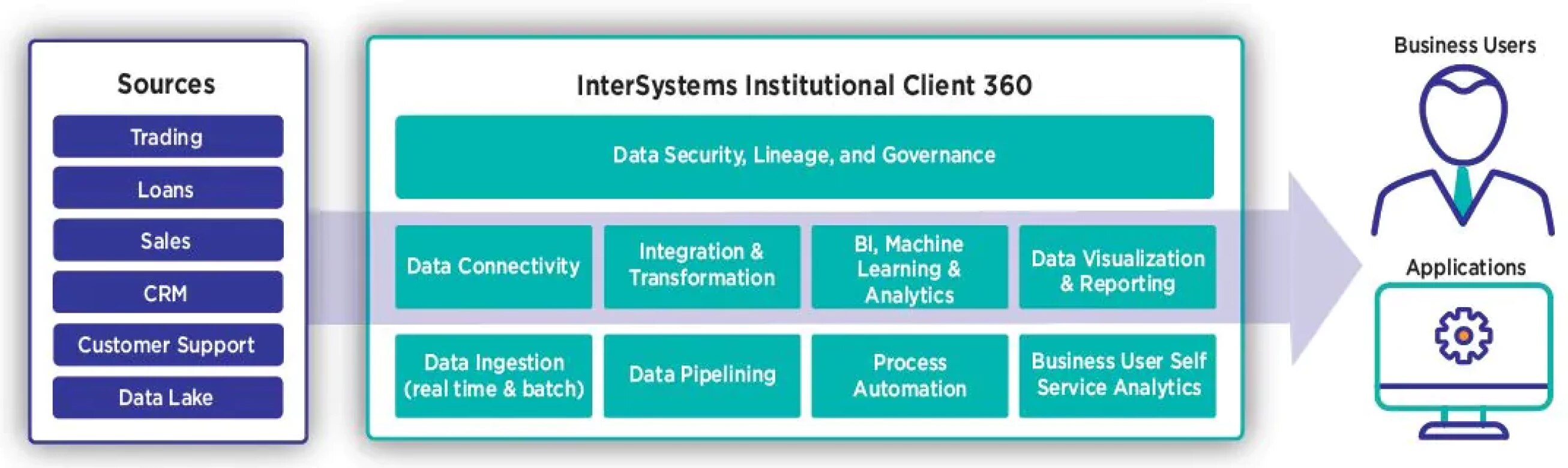

InterSystems Institutional Client 360 enables investment management organizations to achieve a holistic view of their institutional clients and to gain the critical insights needed to create and execute more effective customer strategies.

The solution uses a new, innovative architectural approach, the smart data fabric, which provides an overarching and nondisruptive layer that connects and accesses information from source systems on demand. The solution is ideal for complex data environments and eliminates delays that can lead to errors, missed opportunities, and decisions based on stale or incomplete data.

Institutional Client 360 connects existing systems and data silos inside and outside the organization on demand, ensuring that the information is both current and accurate. It also incorporates real-time event and transactional data along with historical data; provides business users with self-service analytics capabilities, enabling business leaders to make “in the moment” decisions; and addresses limitations of previous approaches, such as the use of dated or static reports.

Institutional Client 360 provides institutional sales and account teams, risk and compliance teams, and other line-of-business users with access to the integrated data required for analytics and insights by focusing on data across domains and functions in the extended enterprise. This provides an aggregated, consolidated, and near-real-time view across multiple systems and areas.

More than just a dashboard, the solution’s self-service analytics capabilities enable business users to explore the data, ask ad hoc questions, and drill down via additional queries based on initial findings. Firms can choose to incorporate advanced analytics and machine learning into the dashboards and reporting screens to gain further insights.

Key Benefits of Institutional Client 360 for Financial Services Firms

- Extends the reach and efficiency of sales teams by providing information in an easy-to-access manner

- Enables teams to identify new sales opportunities by making connections between disparate pieces of client data, such as sales contact activities and market activities, sales trends, market intelligence, and transactional data

- Enables organizations to provide a more unified client experience and meet client expectations for the individuals and functions that they interact with, by maintaining a complete and accurate relationship history

- Improves responsiveness and attentiveness, enabling firms to proactively anticipate client needs and address issues such as monitoring alignment with service-level and contract agreements faster

- Allows firms to build a clearer picture of clients, enabling hyperpersonalization of services and products

- Simplifies efforts to respond to compliance and reporting data requirements by providing access to consistent data from across the organizatio

- Enhances collaboration across the organization by integrating front-office client servicing and sales activities and back-office transactional data

- Improves visibility of both internal and external client-related issues, enabling organizations to be more responsive to events, reduce churn, and better predict future scenarios