Financial Institutions embrace Smart Data Fabric approaches to better leverage enterprise-wide data for advanced insight capabilities

Executive Summary

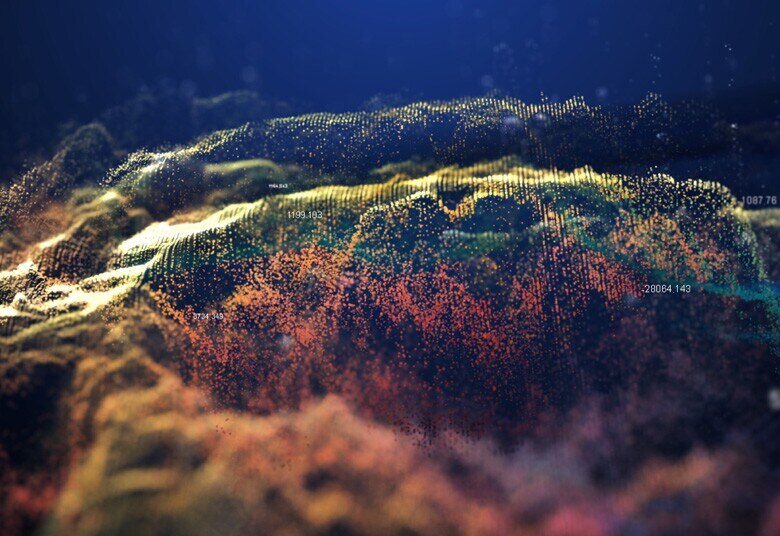

Line of business (LOB) and technology heads at wholesales financial institutions (FIs) come from different angles in wanting to realise business outcomes and gain competitive advantage, but data is a unifying thread. As FIs move from process- to platform-driven organisations, the business focus has shifted to customer experience. This shift requires mastering and leveraging data for insight at an enterprise level. Leading FIs are turning to Enterprise Data Fabrics, the latest evolution of data management approaches, for help.

While excitement over advanced analytics, data science, and artificial intelligence (AI) is palpable, easy access to data—where, when, and by whom it is needed—is a work in progress. A wide mix of data types and systems and a history of disjointed business expansion common to FIs means data remains siloed across numerous platforms, tuned for very different use cases.

Within capital markets and across banking for example, trends such as the move to cross-asset trading at both asset managers (buy side) and banks/brokers (sell side), requirements for 360-degree customer views, the continual regulatory onslaught, and a desire to simplify architecture mean it is time for a rethink in the approach to data management and analytics. A key question for today’s FI is whether a trade-off in cost versus performance when architecting data infrastructures—which dictates different solutions by use case—still holds true.

In other words, is having different data management platforms or centralised data stores by use case cause still required? What if one data management platform could service enterprise data management and analytics needs, regardless of the end user? What innovation could be unleashed with freer access by business users to data and data tools? Celent research has found that leading capital markets’ FIs are exploring Data Fabric approaches to answer these questions.

This research report aims to review Data Fabric approaches empowering FIs to achieve smarter data enablement, “information fluidity,” and a simplified data architecture. This paper also discusses how leading Financial Institutions are positioning their business for success in utilising high fidelity data and coherent collaboration across the enterprise by embracing “Smart” Data Fabric approaches.