Improving Decision Intelligence in Banking Starts with Data

Decision Intelligence in Banking

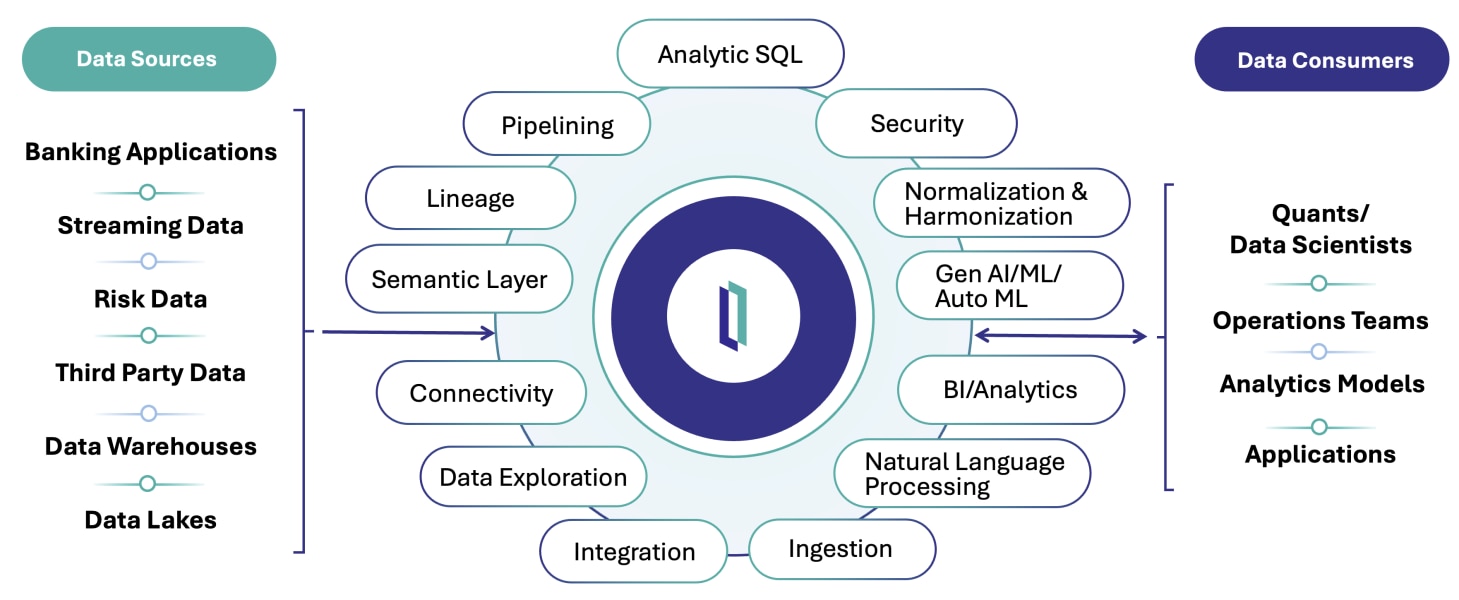

InterSystems connects your decision intelligence ecosystem to a single, high-quality data source at every stage of the process. Our solutions unify data from multiple systems, including internal and external sources such as banking applications, data warehouses, CRM systems, transaction platforms, and third-party sources/services. By integrating data from multiple systems, banks can boost performance in their operations—enabling real-time analytics and AI models to deliver actionable insights at the point of need. Improved data availability ensures banks can make data-driven decisions and extract valuable insights in real time.

When decision-making is powered by a unified data layer, banks can increase agility, reduce costs, and unlock new growth opportunities.

InterSystems connects your decision intelligence ecosystem to a single, high-quality data source at every stage of the process. Our solutions unify data from multiple systems, including internal and external sources such as banking applications, data warehouses, CRM systems, transaction platforms, and third-party sources/services. By integrating data from multiple systems, banks can boost performance in their operations—enabling real-time analytics and AI models to deliver actionable insights at the point of need. Improved data availability ensures banks can make data-driven decisions and extract valuable insights in real time.

When decision-making is powered by a unified data layer, banks can increase agility, reduce costs, and unlock new growth opportunities.

Read insights from 100+ retail banking leaders in North America and the UK in Celent’s latest research, revealing how banks are prioritising model and data management across their business units.

Download the eBook

Powering Real-Time Decision Intelligence in Banking

To address these challenges, banks need easy-to-use tools that simplify data integration and improve data quality, enabling teams to leverage advanced analytics and AI more effectively.

By adopting smart data fabric architectures, banks can unify data across silos, reduce latency, and improve data quality—empowering decision intelligence systems to operate at the speed and precision today’s market demands. Artificial intelligence and automation can be leveraged to automate decisions, enabling banks to make faster and more accurate choices in their operations.

Data Management for Decision Intelligence

Fragmented data and siloed systems continue to hinder banks’ ability to improve decision intelligence. According to recent research by Celent*, data management is among the top investment priorities for banks seeking to modernise their decision-making capabilities. Difficulty with integrating new data sources, poor data quality, and data latency degrade the performance of AI and analytics models. These challenges are especially pronounced in institutions still reliant on complex data architectures, which struggle to deliver the real-time, high-quality data needed for accurate and timely decision-making.

Effective data management also helps banks manage fraud risk by enabling them to identify suspicious activities quickly and implement strategies to prevent fraud, protecting their valuable assets and ensuring operational integrity.

InterSystems enables banks to improve decision intelligence models faster by enabling banks to easily integrate new data sources and connect to data at the source and in real time—without duplication or manual wrangling. Our solutions automate data integration, enforce governance, and ensure data quality, supporting scalable and compliant decision intelligence.

* Celent “Celent Decision Intelligence and Data Survey 2025”

Key Benefits of Decision Intelligence

to see these advantages in action.

and Trust

The InterSystems Difference

We offer a comprehensive suite of cloud-first solutions that empower organisations to build and deploy high-performance, real-time intelligent applications. Our innovative technologies enable seamless integration, orchestration, and AI-driven insights across data and application silos, helping businesses unlock the full potential of their data to solve any business challenge.

Supporting Innovation in

Financial Services for Decades