Asset management firms are under more pressure than ever to deliver consistent value. Gone are the days when strong market performance alone could ensure profitability. Today, an era marked by economic uncertainty, geopolitical instability, and rapid technological change, firms must differentiate themselves through innovation, operational efficiency, and superior client experiences. At the heart of this transformation lies a powerful intangible asset: data.

A global survey by InterSystems of 375 asset management firms reveals a compelling truth—data is no longer just a byproduct of operations; it’s a strategic differentiator. Yet, many firms are still grappling with outdated systems, data silos, and inefficient workflows that hinder their ability to compete.

This blog post explores the key findings from the InterSystems report Data: A Competitive Differentiator, highlighting how asset managers can turn data challenges into competitive advantages.

The Data Dilemma in Asset Management

Despite the growing recognition of data’s strategic value, many asset management firms continue to struggle with fundamental data challenges. These issues are not just technical—they have real business consequences. From inaccurate reporting to delayed decision-making, poor data management can erode trust, increase risk, and hinder growth. The InterSystems survey reveals that firms are dealing with a complex web of data sources, legacy systems, and manual processes that make data access difficult, limiting the ability to retrieve and utilize timely, accurate information. These challenges are particularly acute for smaller firms, which often lack the resources to manage data at scale. Understanding the scope of these issues is the first step toward solving them.

Data Errors and Inaccuracies

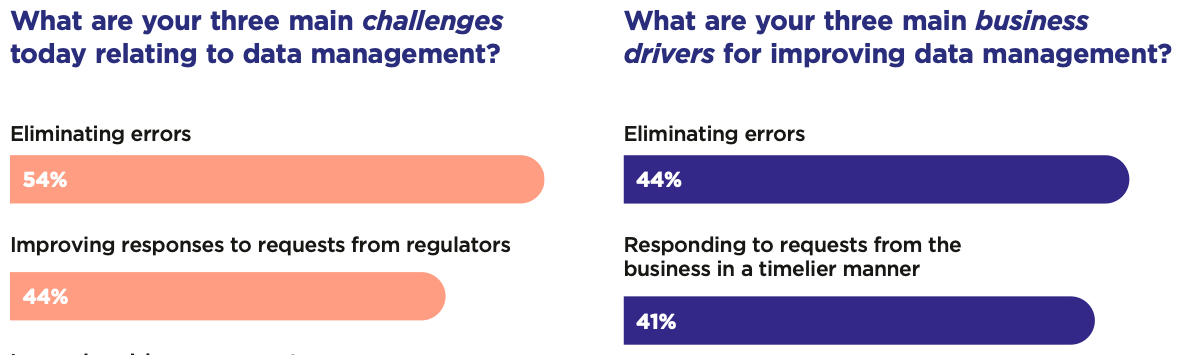

Over 54% of firms report being challenged by data errors. These errors stem from the sheer number of disparate data sources and the manual effort required to integrate, validate, and reconcile data. Inaccurate data not only undermines decision-making but also increases compliance risks and operational costs.

Outdated Information

Only 3% of firms use data that is less than five hours old for reporting. Even more striking, no firms with $100B to $500B in assets under management (AUM) reported using data less than one hour old. This lag in data freshness severely limits firms’ ability to respond to market changes in real time. Having access to fresh data gives organizations a significant competitive advantage by enabling timely and informed decision-making.

Resource Strain

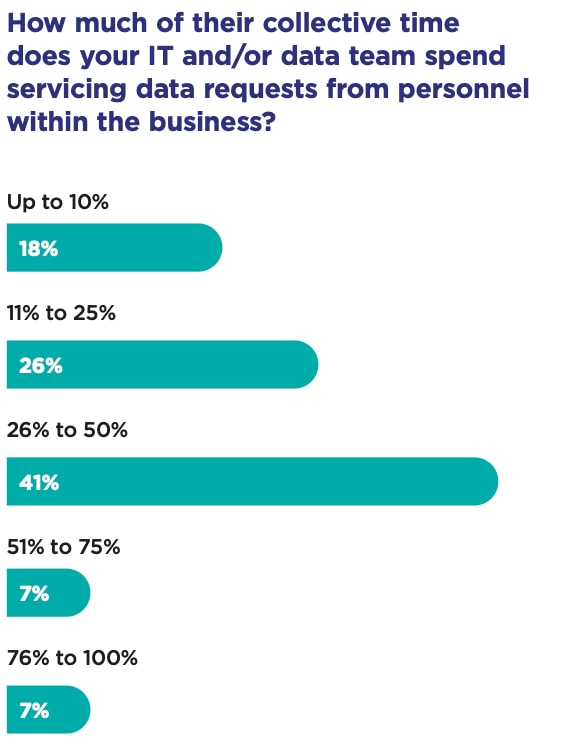

Small to mid-sized firms, despite having fewer resources, often rely on 20 to 29 data sources, just like their larger counterparts. This places a disproportionate burden on their teams. In fact, 41% of respondents said their IT and data teams spend up to 50% of their time servicing data requests from business stakeholders.

Why Data Management Matters More Than Ever

The report makes it clear: data is the new battleground for competitive advantage. As the financial landscape becomes more complex and competitive, the ability to quickly access and act on accurate data is a key differentiator. Asset management firms now have access to more data than ever before, increasing the need for advanced data management solutions. Firms that can streamline their data operations are better positioned to respond to market changes, meet regulatory demands, and deliver superior client experiences. Moreover, data is the foundation for emerging technologies like artificial intelligence and machine learning, which promise to revolutionize investment strategies and operational workflows. Managing enterprise data across various systems and architectures is essential to fully leverage these technologies. In this context, data management is not just a back-office concern—it’s a strategic priority that can drive performance, innovation, and long-term success. Firms that can harness their data effectively stand to benefit in several key areas:

Faster, Smarter Decision-Making

Real-time access to clean, integrated data enables front-office teams to make more informed investment decisions. This agility is crucial in volatile markets where timing can make or break performance.

Improved Risk Management

With better data comes better visibility into exposures, correlations, and market dynamics. This allows firms to proactively manage risk rather than react to it.

Regulatory Readiness

Regulators are demanding more transparency and faster reporting. Firms with robust data infrastructures can respond more quickly and accurately, reducing compliance costs and avoiding penalties.

Enhanced Client Experiences

Clients today expect personalized, timely insights. A unified view of client data enables firms to deliver tailored services and build stronger relationships.

The Shift Toward Smarter Data Strategies

Encouragingly, the industry is responding. Recognizing the limitations of their current data infrastructures, many asset management firms are now prioritizing investments in smarter data strategies. This shift is driven by a desire to eliminate inefficiencies, reduce errors, and empower business users with faster access to insights. According to the InterSystems survey, a significant majority of firms are planning to enhance their data capabilities in the near future. This includes adopting new technologies, rethinking data architectures, and fostering a culture of data-driven decision-making. Many firms are now adopting new approaches, such as data fabrics, to unify and manage data across multiple sources. Essential components of these modern architectures include robust data pipelines and data services, which enable seamless integration and delivery of data throughout the organization. Foundational to these smarter data strategies are strong data collection and data preparation processes, ensuring data quality and readiness for analysis.

The move toward smarter data strategies reflects a broader industry trend: the realization that data is not just a byproduct of operations, but a critical enabler of competitive advantage. According to the survey:

- 73% of firms plan to invest in additional data management capabilities.

- The top drivers include eliminating errors, improving responsiveness to business needs, and lowering data management costs.

This shift reflects a growing recognition that data is not just an IT issue—it’s a business imperative.

How Does a Modern Data Strategy Look?

To unlock the full value of their data, asset managers must rethink their approach. A modern data strategy goes beyond simply collecting and storing information. It involves creating a dynamic, integrated ecosystem that enables real-time access to high-quality data across the organization, with seamless data movement and data transformation across systems to ensure unified and efficient operations. This requires a combination of new architectural approaches, automation, robust governance frameworks, and a clear understanding of business needs. Key components include smart data fabrics that unify disparate data sources, automation tools that reduce manual effort and self-service analytics platforms that empower users at all levels. Automation and governance should also leverage data orchestration to ensure compliance and operational efficiency.

Importantly, a modern data strategy must be scalable and adaptable, capable of evolving with the firm’s goals and the broader market landscape. By enabling advanced data analytics and delivering proactive business insights, asset managers can unlock the full potential of their data. Here are five pillars of a modern data strategy:

Smart Data Fabric Architecture

A smart data fabric integrates data across silos—whether on-premises, in the cloud, or from third-party sources—without requiring data duplication. This enables real-time access to a unified view of data, dramatically improving speed and accuracy.

Automation and AI

Automating data ingestion, cleansing, and reconciliation reduces manual effort and errors. Layering AI on top of this foundation can uncover patterns, predict trends, and generate actionable insights.

Self-Service Data Discovery

Empowering business users with intuitive tools to access and analyze data reduces dependency on IT and accelerates decision-making.

Data Governance and Security

As data becomes more accessible, governance becomes more critical. Firms must ensure data quality, lineage, and compliance while protecting sensitive information.

Scalability and Flexibility

A modern data platform must scale with the business and adapt to new data sources, regulatory requirements, and market conditions.

Case in Point: Empowering Clients Through Real-Time Reporting

One of the most compelling examples of data-driven transformation in asset management comes from the client side. A prominent asset management firm recently implemented a smart data fabric architecture to unify and streamline its data infrastructure. As a result, clients now benefit from a real-time, interactive reporting experience that has fundamentally changed how they engage with their portfolios.

Instead of waiting for monthly statements or scheduled advisor meetings, clients can now access a secure, personalized dashboard that updates in real time. This platform allows them to view current portfolio performance, asset allocation, risk exposure, and market trends—all in a single, intuitive interface. Clients can filter data, run comparisons, and even explore hypothetical scenarios to better understand the potential impact of market movements.

The impact has been profound. Clients feel more informed, more in control, and more connected to their investment strategies. Advisors, equipped with the same real-time insights, can proactively reach out with tailored recommendations, fostering deeper trust and collaboration. This shift from static reporting to dynamic, data-driven engagement exemplifies how smart data fabrics not only enhance operational efficiency but also elevate the client experience—turning data transparency into a true competitive advantage.

Data Integration and Interoperability: Connecting the Dots with a Data Fabric Architecture

As we established, asset management firms rely on many data sources for daily decisions. They must navigate a complex ecosystem of data warehouses, data lakes, and cloud environments, each holding valuable but often isolated information. Achieving true data integration and interoperability is essential for transforming this scattered data into a strategic asset.

Data analysts and data engineers are at the forefront of this effort, working to connect the dots between a broad range of data sources. By leveraging a data fabric architecture, organizations can unify data across silos, enabling seamless data sharing and movement without the need for extensive data duplication. This approach not only streamlines data integration but also ensures that relevant data is accessible to those who need it, when they need it.

With a unified data fabric in place, data analysts can perform more effective data analysis, drawing on all the data available to deliver meaningful insights that drive business decisions. Breaking down data silos empowers teams to collaborate more efficiently, respond to market changes in a timely manner, and maintain a competitive edge. Ultimately, robust data integration and interoperability are the foundation for smarter, faster, and more informed decision-making in asset management.

The ROI of Better Data

Investing in data management isn’t just about compliance or efficiency—it’s about growth. Better data management delivers tangible returns across multiple dimensions. Operationally, it reduces the time and cost associated with manual data processing and error correction. Strategically, it enables faster, more accurate decision-making that can improve investment outcomes and client satisfaction. From a compliance perspective, it ensures timely and accurate reporting, reducing the risk of fines and reputational damage. Perhaps most importantly, it lays the foundation for innovation—enabling firms to develop new products, enter new markets, and respond more effectively to emerging trends.

In a competitive industry where margins are tight and expectations are high, the return on investment in data management is both measurable and meaningful. Firms that get it right can:

- Reduce operational costs by automating manual processes.

- Accelerate time-to-insight for faster, better decisions.

- Enhance client satisfaction through personalized, timely service.

- Improve compliance with faster, more accurate reporting.

- Drive innovation by enabling new data-driven products and services.

Data Management Best Practices for Asset Managers

For asset managers, effective data management is the cornerstone of successful investment strategies and operational excellence. To ensure that data is both trustworthy and actionable, firms must adopt best practices that span the entire data lifecycle—from data capture and transformation to data storage and integration.

A strong data architecture, such as a smart data fabric, is essential, providing a central repository that accommodates all data types and supports seamless data integration across the organization. Asset managers should implement rigorous data quality controls, ensuring that only accurate and relevant data informs investment decisions. Data security is equally important; robust access controls and compliance with data privacy regulations protect sensitive information and maintain client trust.

Leveraging advanced technologies such as machine learning and artificial intelligence can further enhance data-driven decision making. These tools enable asset managers to analyze large, complex data sets, uncover new insights, and respond proactively to market trends. By embedding these best practices into their data management processes, asset managers can foster a data-driven culture that supports innovation, compliance, and long-term business success in today’s digital economy.

From Data Burden to Competitive Edge

While data challenges in asset management are widespread, they are not insurmountable. With the right strategy, tools, and mindset, firms can transform data from a burden into a valuable asset. This transformation requires commitment—from leadership buy-in to cross-functional collaboration—but the rewards are substantial. Firms that succeed will not only improve their operational efficiency and regulatory compliance but also gain a powerful edge in delivering value to clients. In a world where every basis point counts, smarter data isn’t just a competitive edge—it’s a competitive necessity.

InterSystems offers a transformative approach to data management through its smart data fabric architecture, powered by InterSystems Data Studio. This solution, with its asset management module, is purpose-built to address the fragmented, error-prone, and slow data environments that many asset managers face. By seamlessly integrating data across internal systems, third-party sources, and cloud platforms InterSystems enables real-time access to a unified, trusted view of information. The asset management module adds domain-specific capabilities, including prebuilt data models, workflows, and data connectors tailored to asset management firms. This empowers firms to reduce manual reconciliation, bridge data silos, and deliver timely insights to both internal teams and clients. With built-in support for governance, scalability, and AI-driven analytics, InterSystems not only streamlines operations but also positions firms to innovate and compete more effectively in a data-driven market.

Learn more about how InterSystems is helping asset management firms turn their data into a competitive advantage: InterSystems.com/Asset-Management.