CUSTOMER: Financial Center First Credit Union

CHALLENGES: During COVID-19, ensure members have financial peace of mind

OUTCOME: Predictive analytics drive successful member outreach

Member Campaign Speaks to Current Crisis, Builds on Credit Union’s Pillars

As one of the strongest credit unions in the country, InterSystems long time customer, Financial Center First Credit Union (FCFCU) is well capitalized. So when COVID-19 struck, the credit union was determined to provide members with financial peace of mind and ensure those in need would have access to funds as part of its “We Care” campaign.

While the campaign focused on helping members through this difficult time, it was built on the following three pillars that define the purpose of the credit union:

- Feeding the Hungry: helping local food pantries feed over 300,000 people per year.

- Supporting our Military: the credit union’s Chairman and CEO founded and helped raise funds to build and launch the Indiana Veteran’s Hall of Fame.

- Being the best in Adult Financial Literacy: the credit union’s commitment is evidenced by having earned six national industry awards for adult financial literacy.

Being a purpose-driven credit union has a lasting effect on members and the community at large. Helping one member improve their financial life impacts their family and that family contributes to the economy of their local community. When communities are improved, it can make a difference in the world. From the perspective of Financial Center First Credit Union, when you’re purpose driven, the numbers take care of themselves.

Powerful analytics identify members most in need of support

Relying on InterSystems data platform technology for predictive analytics, Financial Center was able to build a powerful application that:

- Identifies members most likely to need assistance by offering fee waivers, loans, competitive deposit rates, the option to skip a payment, and more.

- Provides members with the assurance that the credit union can provide access to money and financial products including home equity lines of credit, refinancing, and loans.

- Aligns employees with members they have previously engaged – ensuring there’s a familiar voice on the other end of the phone offering financial advice and assistance.

- Creates relevant and helpful talking points for employees calling members.

“Instead of waiting for members to contact us when they were already in a stressful financial situation, we proactively reached out to them. Using predictive analytics, we identified the members most likely to need support and by initiating calls, we were able to build stronger relationships,” said Cameron Minges, Executive Vice President at Financial Center.

5 Minute Spotlight: Driving Customer Success with Analytics at Financial Center First Credit Union

A conversation with Joe Lichtenberg, Global Head of Product Marketing at InterSystems and Cam Minges, President FCFUC

Knowing which members to reach with the right message at the right time

Going deeper into its predictive analytics, Financial Center knew that a successful campaign required more than reaching out to members – they needed to reach out to members at the right time.

To do this, Financial Center created a process for quickly generating accurate call lists. “The key to using analytics is to build relationships with members, not as a gotcha,” added Minges.

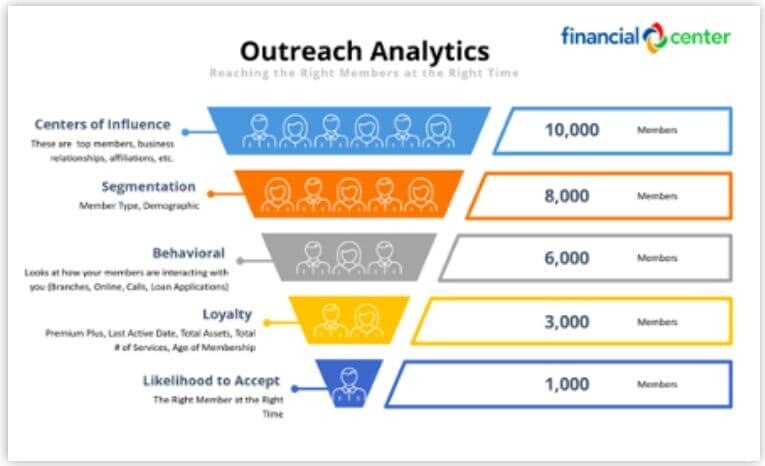

Once a call list is built, analytics once again play a critical role in ensuring the right members are reached at the right time. To do this, each outreach list is run through an analytics funnel that focuses on the following four key areas.

Centers of influence: This includes insurance brokers, who work with employer groups, who in turn become credit union members. Identifying the centers of influence first helps whittle the list and ensures that the right staff member is contacting the appropriate organization.

Segmentation: The two segmentation types that were used are based on demographics and the type of relationship the member has with the credit union.

Behavioral patterns: The use of analytics to identify behavioral patterns across branch transactions, online lending, the call center, and other critical touch points has always been key to knowing when to contact a member. Prior to COVID-19, the credit union tracked four behavioral patterns and now they have increased it to 31 to gain deeper insight.

Loyalty: The credit union has created a loyalty matrix score based on member type, total aggregate relationships which includes number of accounts or financial products, levels of engagement activity, and length of membership.

Based on these factors, Financial Center can accurately predict the members who are most likely to accept an offer.

Investing in Members Pays Off

Financial Center measures the success of it’s efforts based on how many members they are able to help. Before COVID-19, the average number of calls per month was fewer than 2,000. Today, the average is 9,000 calls per month. The credit union was able to integrate analytics capabilities and produce three of the top lending months in its 67-year history.

Every week the credit union creates a dashboard showing how many thousands of members’ lives they’ve positively influenced. The metrics shown include number of members contacted and reached, products and services used, transactions, and more. The dashboard is a reminder to the team that every day they’re making a difference in members’ lives.